One of the best and most underutilized features in Oracle’s Strategic Modeling product is the Debt Scheduler. This tool allows users to input the basic parameters of a Debt Issuance in a wizard-based interface with the resulting amortization schedules and related outputs automatically calculated. This greatly reduces the amount of time it takes to model an issuance.

Think about all the accounts that are impacted on the financial statements from a single debt issuance!

P&L

- Interest Expense

- Amortization of Debt Financing Fees

- Amortization of Premium/Discount

Balance Sheet

- Principal Balance

- Current Portion of Long-Term Debt

- Long-Term Portion of Long-Term Debt

- Unamortized Issue Costs

- Unamortized Premium/Discount

- Accrued Interest

Cash Flow

- Cash Interest Payments

- Principal Payments on Debt

- Proceeds from Debt Issuance

- Payments of Debt Financing Costs

Correctly modeling these issuances and then linking them into existing financial statements in Excel or any other system would take many hours or even days. With the Debt Scheduler in Strategic Modeling, this can all be done in a couple minutes.

Now with the 23.06 release, Oracle has made a great feature of Strategic Modeling even better with several important enhancements.

New Interest Rate conventions

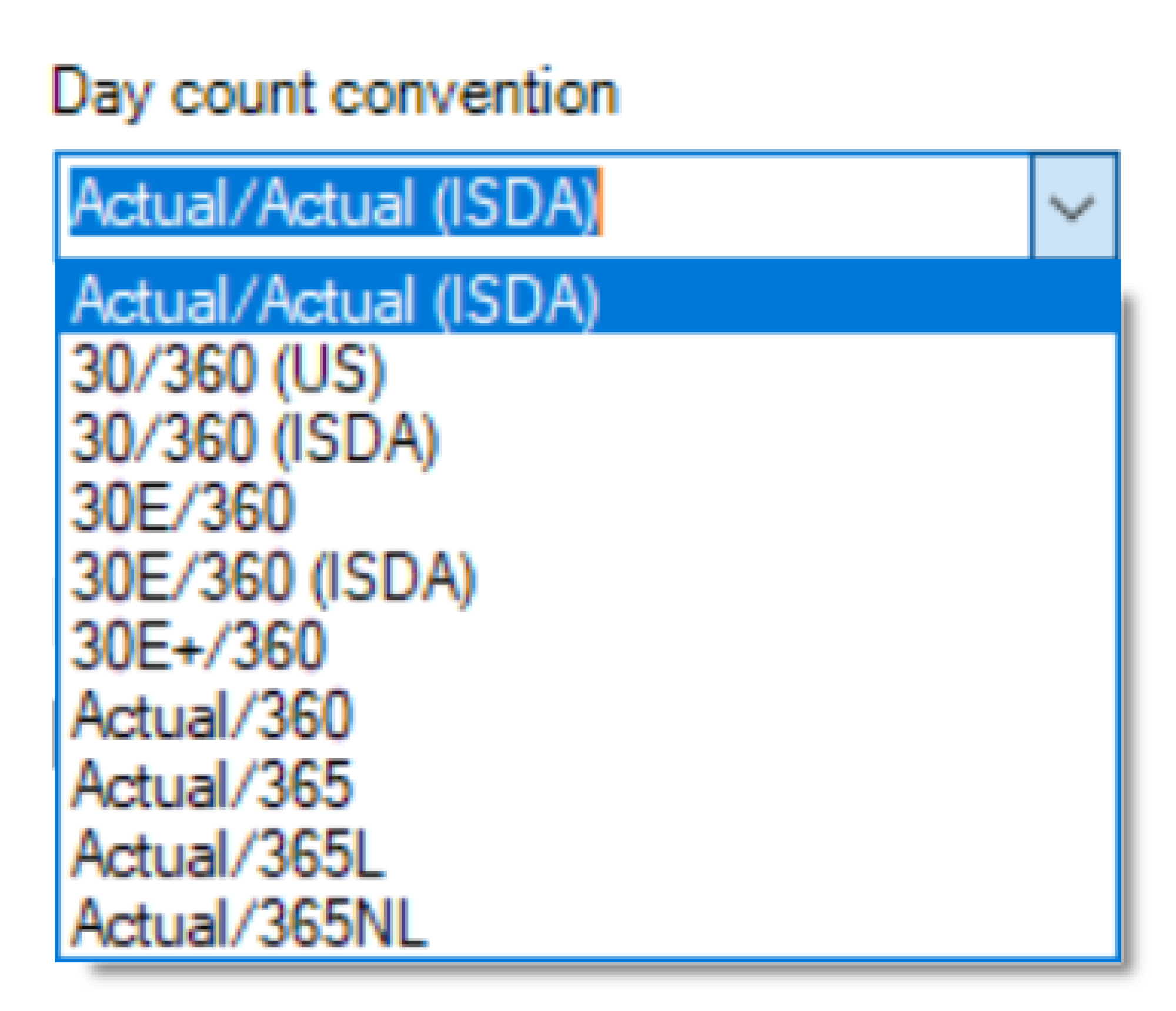

With the proliferation of different types of Debt Issuances with different day count conventions, Oracle has enhanced the Debt Scheduler to now include 10 different conventions. While 30/360 and Actual/Actual continue to be the most commonly used, Oracle now provides the following conventions for calculating Interest Expense that you can easily select from a drop-down menu:

For detailed explanations on each of these Day Count Conventions, you can check out this website.

Dated Date Concept

The dated date is the date when interest begins to accrue on a debt instrument. Typically, this is the same date as the Issue Date and therefore on most implementations it was ok that the Debt Scheduler previously only had an Issue Date field. However, periodically we encountered a client that had a debt instrument whose interest payments didn’t align with the Issue Date and required a Dated Date field. The inclusion of this field (in addition to the pre-existing Issue Date field) and corresponding interest calculation logic in Strategic Modeling solves this issue.

As an example, we had a recent client who had a Bond with an Issue Date of 10/31/2019 with Term Date of 1/31/2030 (10 years & 3 months). They had Semi-Annual interest payments on January 31 and July 31. With the new Dated Date functionality in the Debt Scheduler, we can enter in the Issue Date of 10/31/2019 and a Dated Date of 1/31/2020 and the Debt Scheduler will now correctly calculate Interest Expense and Accrued Interest for this issuance.

Ability to model Debt Tender Offers and Prepayments

One of the great features of the Debt Scheduler is that you can typically “set it and forget it.” Meaning that once you spend a couple minutes to input the initial parameters of a Debt Schedule, most issuances amortize on a very orderly schedule and no adjustments or ongoing maintenance are required as time marches on -- the debt scheduler does its thing and models Principal Payments, Interest Payments, Amortization of Debt Issue Costs, etc. until the Debt Issuance’s eventual maturity. Having said that, some clients of ours issue tenders and/or make prepayments on their debt which fundamentally alters the original schedule that was created. While you could always adjust the principal balance with the previous version of the Debt Scheduler, the Amortization of Debt Issue Costs and/or Amortization of Premium/Discount could not be adjusted in kind.

Oracle has now introduced a simple checkbox to the Debt Scheduler wizard that states, “Amortization follows principal”. What this means is that if any Tender Offer or Prepayment is made that reduces or fully pays off the Principal Balance, the Amortization of Issue Costs and/or the Amortization of Premium/Discount will reduce proportionately with the principal reduction.

The Debt Scheduler has always been one of the great features of Strategic Modeling and it covered 80% of the use cases with ease. By extending its capabilities to include additional interest rate conventions, dated date functionality, and the ability to better model prepayments and tender offers, Oracle’s Strategic Modeling now has a very complete feature set that covers the vast majority of debt issuances and related modeling considerations with an out-of-the-box tool that greatly simplifies the modeling effort for our Treasury and Financial Planning & Analysis clients.

For comments, questions, or suggestions for future topics, please reach out to us at [email protected]. Visit our blog regularly for new posts about Cloud updates and other Oracle Cloud Services such as Planning and Budgeting, Financial Consolidation, Account Reconciliation, and Enterprise Data Management. Follow Alithya on social media for the latest information about EPM, ERP, and Analytics solutions to meet your business needs.