At Alithya, our capital-intensive clients ask for help streamlining their capital request, prioritization, and approval systems. As capital projects become more expensive with investments in modern facilities and equipment, many teams are looking to optimize their capital investment processes and make sure their high-profile, high-spend, high-impact investments are well managed with good stewardship.

The numbers are LARGE – some capital spending stats, according to the 2021 US Census, in 2019:

- Higher Ed – $31.8B a year

- Healthcare – $116.7B a year

- Transportation – $128.6B a year

With capital spend growing – organizations ask for help to revamp capital programming when they see their annual capital portfolio reach a 100+ capital requests per year, culminating in $100M+ of capital spend per year. When capital programs get to this scale, organizations can no longer effectively manage portfolios merely utilizing Excel and Email. With your capital program locked in Excel, it’s too easy for the organization to make the wrong investment or overspend on in-flight projects.

When capital spend hits this level, we see the following recurring themes:

- An opaque capital investment pipeline

- Cross-functional teams are not involved early enough in the capital request process

- Capital requisition process is annual (not real-time)

- There is little linkage between capital requests and the organization’s capital constraint

- Capital spending not linked to the organization’s strategic plan

- Incomplete capital requests and surprise project overruns

- The process is too manual – utilizing Excel, Word, and Email

Challenge #1 – An opaque capital investment pipeline

Treasury and Finance have limited visibility into the longer-term needs of departments and business units. Finance only gets an annual glimpse during the capital request cycle when hundreds of requests surface and need to be quickly prioritized. It’s hard to really understand, prioritize, and guide in a time-compressed period.

Ideal state: Departments continuously enter their capital needs into a sandbox – so departments can begin thinking strategically and build their own “mini-investment roadmaps.” During the capital cycle, a department can cherry pick select requests, and submit for approval. If they’ve been working on their capital needs throughout the year, the capital prioritization process will be much smoother. And – at the same time - Treasury and Finance can aggregate sandbox information to look for themes, trends, and emerging needs.

Challenge #2 - Cross-functional teams find out about proposed investments too late

Without a system helping drive the capital program process, departments don’t always know who to involve in various capital requests and when to involve them. Often, support functions like IT, Facilities, or Purchasing get notified to ‘start work’ on a project that they had no input or visibility into.

Alithya has recognized a few real-world examples:

- A department receives approval to purchase a piece of equipment, but no one realized the Facilities Department needs to build-out a room.

- Two departments are soliciting approval to purchase the same item, but the Purchasing Department finds out too late – missing out an opportunity to take advantage of better purchasing terms.

Ideal state: As capital requests are promoted out of a department’s sandbox, cross-functional teams get visibility to new requests via dashboards that highlight new, relevant requests. If there is a question about something new on the list – they can escalate their concern – or acknowledge that they have seen the request.

Challenge #3 – Capital Request Process is not real time

Too often, the capital request process runs annually, a capital program with a list of projects gets approved - and then the fiscal year starts a few months later. Often, business units, functions, and VPs are left to self-administer within their capital allotment contingencies. But much like the previous two challenges – the rest of the organization is not getting a real-time view of the current capital need.

Ideal state: An annual request process establishes each function’s routine capital contingency. A system should administer a standard request workflow for ‘routine requests.’ As the fiscal year progresses, routine investments should be requested and adjudicated - and communicated to cross-functional teams so they are afforded the opportunity to review items that may impact them.

Challenge #4 – Little linkage between capital pipeline and organization’s funding capacity

As the organization thinks about capital improvements several years out, most do not have a formal methodology to look at the various capital structure and funding scenarios that drive the organization’s capital capacity.

Ideal state: Implement a capital funding capacity model to evaluate various scenarios to set the capital program budget. Typical scenario modeling includes analyzing options such as adjusting fees, fund raising, issuing debt, or drawing from endowments. This scenario model will drive the capital budget limits within the annual request process and allow the treasury function to drive their capital raising plan.

Challenge #5 – Capital spending not linked to the organization’s strategic plan

Organizations need to make important decisions around large capital projects that will impact their finances for many years into the future. However, many organizations do not integrate their capital plan into their strategic plan which prevents them from forming a holistic understanding of the crucial impact these decisions have on their future financial statements and key metrics.

Ideal state: It is important to provide a linkage into the strategic plan so that senior management can gain insight into how capital allocation decisions impact future cash flows and requirements for additional debt or bond issuances. Incorporating debt covenant calculations and credit rating metrics into the strategic plan can provide further understanding into the organization’s future debt and capital capacity. Integrating scenario analysis into the strategic plan around the inclusion/exclusion of unapproved capital projects and the timing of the cash outlays associated with these projects can help organizations optimize their mix of capital projects given their financial projections and associated constraints.

Challenge #6 – Incomplete capital requests and surprise budget overruns

Often capital spend is not being prioritized and managed consistently – leading to: the wrong projects being approved, projects going overbudget, and not all capital costs for a project being estimated.

Ideal state: Define a consistent capital request, prioritization, and approval process that can be universally applied to the organization. Establish rules around how ‘routine capital’ and ‘strategic investments’ should be facilitated by a formal request process, an opportunity to prioritize, and an approval workstream within the organization. Determine when in the prioritization process, cross-functional teams such as IT, Facilities, and Purchasing should receive visibility into a potential investment.

Challenge #7 – The process is too manual – all in Excel, Word, and Email

Even the largest organizations are managing the capital request process via Excel, Word, and Email – with Finance building up spreadsheets of requests. Once the capital program gets prioritized, approved, and project budgets issued – ongoing projects are often managed in Excel with finance managing budget transfers between projects, actuals vs. budget reporting, and placing assets in service.

Ideal state: A capital program system should download cash commitments and cash disbursements from the ERP nightly, and at a level comparable to approved project budgets. If a project is going overbudget, a department should submit a new incremental funding request so the organization can formally decide to continue to fund or terminate the project. Similarly, as projects near completion, a system should automatically flag projects to close.

Alithya’s solution

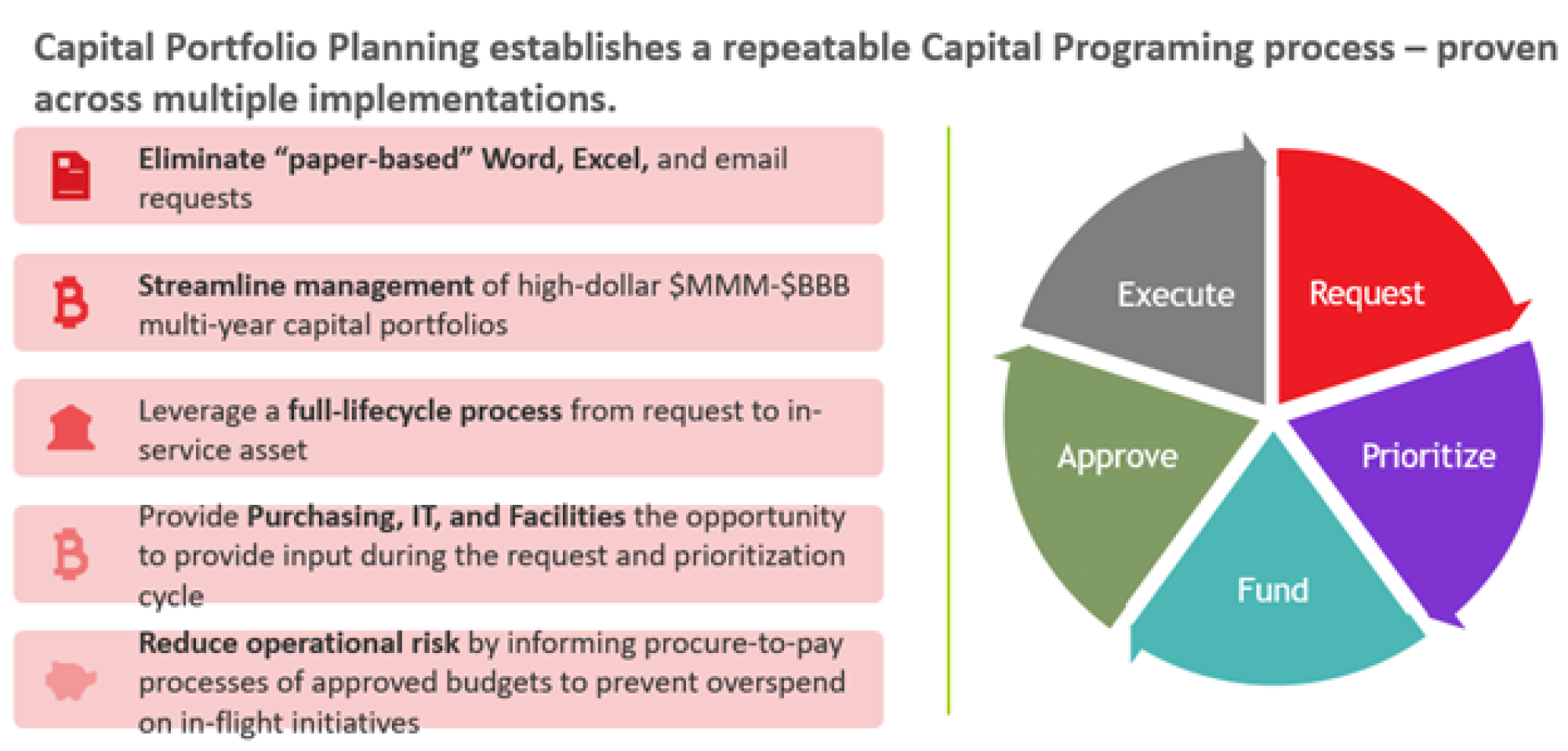

Through our focus in helping clients with this key business process – we have established Alithya’s Capital Portfolio Planning – a repeatable implementation that shortens the time it takes to address these challenges. By using the flexibility of Oracle’s EPM Planning tool, we can quickly implement a robust capital programming process.

To learn more about streamlining your capital programming process, contact Alithya's Oracle experts to undertake our capital programing assessment.

For comments, questions, or suggestions for future topics, please reach out to us at [email protected]. Visit our blog regularly for new posts about Cloud updates and other Oracle Cloud Services such as Planning and Budgeting, Financial Consolidation, Account Reconciliation, and Enterprise Data Management. Follow Alithya on social media for the latest information about EPM, ERP, HCM, SCM, and Analytics solutions to meet your business needs.