Variance Analysis is a format of the Reconciliation Compliance feature set of Oracle Account Reconciliation and another form of reconciliation that occurs during the accounting close process.

What is Variance Analysis?

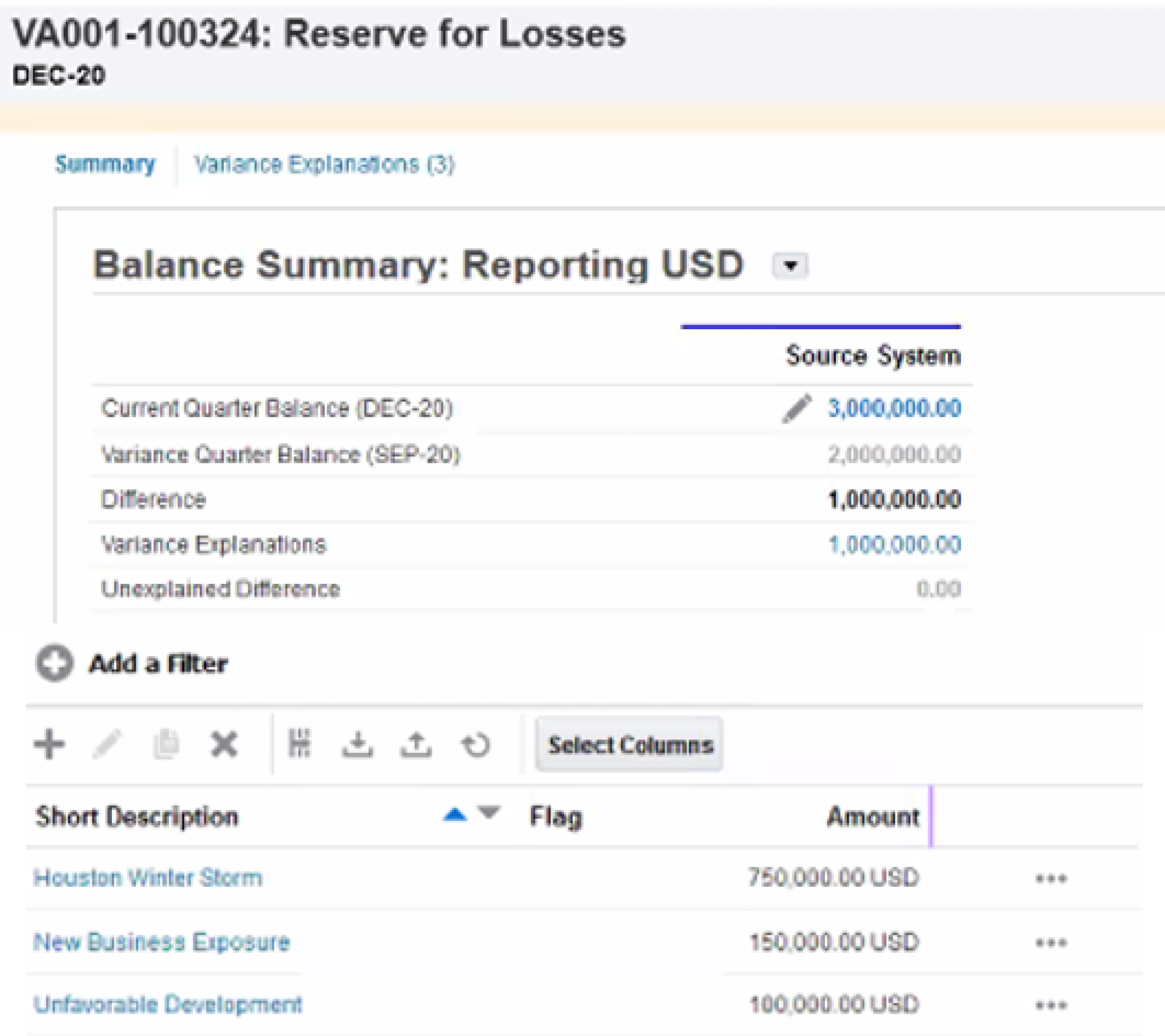

Account reconciliations are a key control to ensure the financial statements are substantiated and the integrity of the amounts presented are not in question. As a result, reconciliations come in various formats and are used for different reasons. People commonly correlate account reconciliations with the reconciliation compliance or transaction matching processes to ensure that data is moving accurately between systems, transactions are being recorded properly, and that the preparation and review has been certified. Variance analysis, many times referred to as fluctuation or flux analysis, is the process of reviewing account balances over a horizon of time (i.e. a month, a quarter, six months, year over year, etc.) and isolating the core reasons for the fluctuation in order to validate the change in the balance sheet account or providing evidence of the period over period change in P&L accounts.

This process happens as part of the subledger review to ensure transactions are recorded accurately before interfaces are run to the ledger, as part of the reporting process to support the audit review, and in preparation of the disclosures and footnotes.

While companies do not perform flux analysis on all of their trial balance accounts, they do commonly perform flux analysis on accounts that have a material impact on the financial statements, had a large period over period fluctuation that will catch the eye of the auditors, and are a risk for a potential misstatement. Prior to joining Alithya, I worked in the insurance industry.

Each quarter, we would perform flux analysis on our reserve (i.e. losses, IBNR, unearned premium, DAC, etc.), investment balances, and equity accounts to ensure that the amounts recorded to the balance sheet were appropriate and the offsetting activity was properly being recorded to the P&L (change in losses paid and unpaid, change in IBNR, etc.) or other balance sheet accounts.

These were our first line of defense reconciliations to ensure that prior to running the interface to the ledger, we knew the data was appropriate, or in the event, there was an issue, it would provide us with support to remediate the issue. We would also perform flux analysis to support our GAAP and statutory financials as part of our supporting documentation in the preparation of our outward-facing financial statements.

Similar to the other reconciliation processes, flux analysis is a time-consuming process as you are reviewing the details of the subledger and ledger to bifurcate the data into common themes in order to ensure you have a correct understanding as to why the account movements are correct or isolating an adjustment that is necessary. While a lot of ERPs can provide you with a report that offers the period over period journals that were recorded, many times the journals are not enough to tell the entire story as to why those journals were recorded and the cause for the movement in the account.

Additionally, the ERPs do not provide you with the ability to provide written explanations and support of the fluctuation. As a result, this work is done within Excel and requires additional supporting documentation (i.e. emails or notes from conversations). When the flux analysis is completed, this information is printed and stored in a binder on someone’s shelf. Similar to the month-end and transaction matching reconciliations, there are physical costs (i.e. paper, ink, binders, and storage) that need to be considered in the legacy process.

How Can Oracle Account Reconciliation Help?

There are five reasons why you should use Oracle Account Reconciliation for your flux analysis needs.

- Multi-Source Integration – companies spend significant time aggregating data from source systems in order to perform flux analysis. Variance Analysis eliminates the data touchpoints and the risk of not having the most up-to-date data by providing the ability to automate data sources into the solution.

- Automation – Variance Analysis drives automation in the identification of outliers, accounts that require explanation, and the certification process. Variance Analysis offers a rules-based solution that can identify accounts that need attention, thus allowing preparers to expedite the examination process.

- Workflow – Variance Analysis provides visibility into the status of the process, as well as capturing feedback from reviewers and commentators.

- Supporting Documentation – Oracle Account Reconciliation provides an electronic paper trail of supporting documentation to remove the need for hard copies and binders. This eliminates physical costs from the flux analysis process and ensures that everything is stored in one place.

- Auditability – Variance Analysis provides an audit trail to provide the ability to understand the entire process, who prepared the flux analysis, and who reviewed it. Additionally, with the ability to attach supporting documentation and provide notes of supporting adjustments or undocumented items, auditors are able to expedite their review processes.

Oracle Account Reconciliation: A Single Solution for the End to End Reconciliation Process

In summation, reconciliations are one of the most critical elements of the accounting close. With a sound reconciliation process, companies are able to proactively mitigate risk and provide clear evidence to auditors and regulators of the integrity of the financial statements.

As you have read in my other blogs, Oracle Account Reconciliation is a flexible and modular solution that provides companies with the ability to standardize and automate the reconciliation process. The two feature sets of Account Reconciliation, Reconciliation Compliance, and Transaction Matching provide companies with a systematic approach that includes multi-source integration, configurable rules, workflow, calendarization of tasks, and accounting controls. Variance Analysis provides companies with the ability to standardize and automate the flux analysis process to validate the period over period results and to ensure balances and activity are accurate and supported.

By leveraging technology to perform these tasks, companies are spending more time analyzing the unbalanced or at-risk amounts and less time aggregating data, rolling forward balances, and manually creating formats in Excel.

At Alithya, we have a diverse mix of consultants that have the functional and technical expertise to streamline your entire reconciliation process, provide you with best practices, and help you to remove manual, tedious activities from the accounting close.

For comments, questions, or suggestions for future topics, please reach out to us at [email protected]. Visit our blog regularly for new posts about Cloud updates and other Oracle Cloud Services such as Planning and Budgeting, Financial Consolidation, Account Reconciliation, and Enterprise Data Management. Follow Alithya on social media for the latest information about EPM, ERP, and Analytics solutions to meet your business needs.