As there is no prescribed methodology to define profitability, the approach to profitability varies dramatically across the insurance industry. Having the ability to understand the underlying details of profitability provides insurance organizations with valuable insight to evaluate potential risks to the organization and pursue opportunities to adapt or transform the business.

Understanding Earnings in the Insurance Industry

Insurance companies create revenue through insurance and investment operations from underwriting and investment activity, as well as fee-based income. From the underwriting operations, they manage both short and long duration policies, which carry an inherent risk that could result in losses that could be attached to a specified horizon or go beyond the life of the policy. The management of these short and long duration policies and the associated underlying risk for losses over a given horizon drives the decision around the duration of the company’s asset allocation within the investment portfolios. While it is critical that insurance companies manage their balance sheets to ensure solvency and the ability to manage future claims, it is also critical to understand the profitability of its operations in order to evaluate opportunity for growth, sustainability, market change, and adaptability.

Modernizing the View of Profitability

The insurance industry faces peaks and troughs with earnings due to market and interest rate volatility, hardening of pricing, material loss events, market disrupters, and other factors. Understanding profitability should not be based solely on a view of consolidated or segment underwriting gain/loss, operating income, or net income. To be able to understand profitability and proactively manage operations, companies need a deeper grain of detail to be able to anticipate and react to change. A systematic, defined understanding of profitability affords insurance organizations the opportunity to swiftly analyze, evaluate options and opportunities, and react. Additionally, as we have seen, market volatility can occur suddenly, having the ability to quickly analyze and adapt profitability models with varying scenarios is important to risk mitigation.

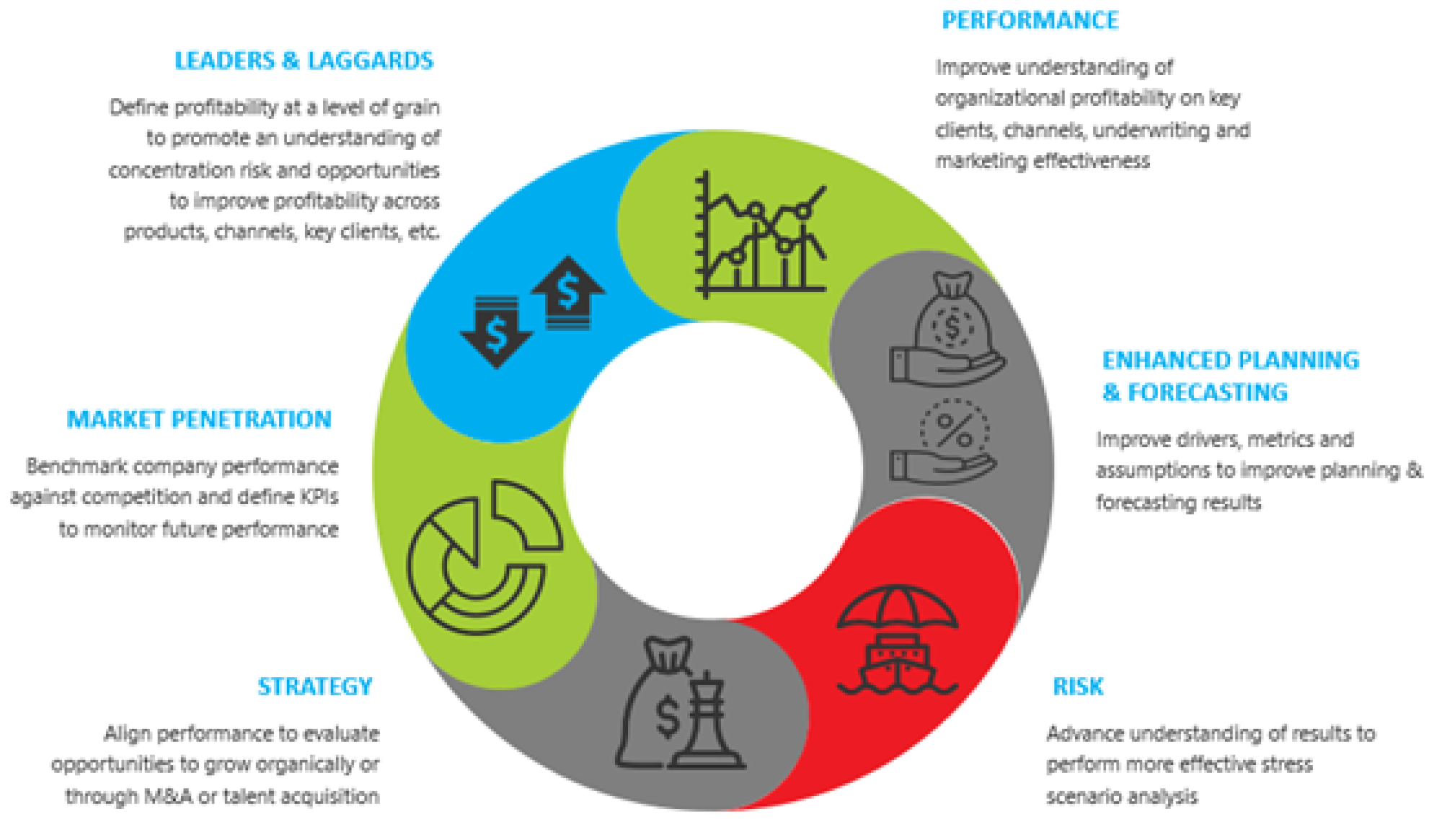

Below, I have outlined six benefits to modernizing and integrating the view of profitability for insurance organizations into key business analysis, decisions, and processes.

1. Performance

Having transparency into profitability allows for an opportunity to assess pricing methodologies, organizational costs, costs to offer certain products, the performance of underwriters, or to certain clients or channels. Additionally, it allows for an opportunity to evaluate the effectiveness of marketing campaigns to drive new business and retain business. Additionally, understanding performance allows insurance companies to evaluate potential profit leakage due to operational inefficiencies.

2. Enhanced Planning and Forecasting

In many insurance organizations, the planning and forecasting process is siloed to the point that the output is used more as a financial tracking tool, rather to support key business decisions or a fully integrated planning process. By using profitability analytics and understanding the key drivers in the company’s premiums, losses, and cost structure (i.e. operating costs, cost containment, or claims costs), insurance companies can more accurately plan and forecast premiums, losses, and operational expenses. Additionally, utilizing profitability analytics to create metrics, assumptions and drivers provides for a rationalized approach that can be benchmarked against historical data.

3. Risk Mitigation

An impactful profitability study affords insurance companies the ability to perform what-if and scenarios-based analysis to leverage trending market data to interpret the potential impact on the company’s financial performance. Additionally, it allows insurance companies the ability to proactively monitor risks and integrate a full vision of profitability and operational performance into its analytics.

4. Strategy

Understanding performance and where there are potential opportunities or a change in approach to the market is critical for insurance companies. It provides the data needed that helps insurance companies to adapt as the market evolves. Profitability analysis provided data-driven analysis to help make key business decisions, including strategic investments, changes in the approach to the market such as a change to an agency model, sidecar business offering, or selling through a third-party administrator. Additionally, it can help support an organic transformation model, as well as understanding the potential impact of key people or asset acquisitions.

5. Market Penetration

Data provides a wealth of information and understanding how insurance companies compete against each other is important. While there is sensitivity around peer analytics, insurance companies can perform competitive analysis to understand where they are performing above or below competitors and to interpret market trends. This alignment of competitive performance allows insurance companies the ability to evaluate market penetration and potential opportunities to expand, contract, or change the approach.

6. Leaders and Laggards

In consolidation, an insurance company can appear to be profitable, but, in reality, there is a balance between the products, channels, clients, counterparties, etc. that are driving profits and others that are not as profitable or are producing losses. Having the ability to understand the contribution to performance allows insurance companies the ability to refine and optimize product offerings, sales channels, the consumers, and the associated costs of those products.

Modernizing Your Company’s Profitability Analytics

Understanding performance, profitability, and outlook is important for all stakeholders, as investors, policyholders, and regulators have a vested interest in the financial sustainability of the organization. Having the ability to gain transparency into organizational performance allows insurance companies the ability to assess the potential impact of various scenarios, proactively react to the impact of changes, and to strategize on ways to improve operational performance and mitigate risk.

As mentioned, having the ability to standardize the view of profitability across an insurance organization allows for a repeatable process that provides transparency into potential risks and opportunities to the organization. Having an understanding of the product, channel, client, etc. contribution to underwriting results is a critical element of managing an insurance company’s book of business and also provides the opportunity to proactively assess the company. Additionally, having an understanding of the profitability of an insurance company’s investment portfolio is also critical to provide clarity into investments that are driving results and those that are not driving returns to the company.

Ask yourself these questions:

- Do you have a systematic, repeatable process for understanding profitability?

- Do you have the ability to drill back into the details of results to understand what drives profits and losses?

- Do you have reports and KPIs that monitor profitability?

- Do you use your profitability analysis to enhance the planning and forecasting process?

- Do you use your profitability analysis to enhance risk and strategic analysis?

Alithya has a proven, comprehensive methodology to help our clients reap the benefits of their technology investments. Our technical and functional knowledge of the insurance industry helps us to provide clients with actionable ways to gain transparency into the profitability to further benefit the company, while also gaining a technology solution that is scalable for future change.

For comments, questions, or suggestions for future topics, please reach out to us at [email protected]. Visit our blog regularly for new posts about Cloud updates and other Oracle Cloud Services such as Planning and Budgeting, Financial Consolidation, Account Reconciliation, and Enterprise Data Management. Follow Alithya on social media for the latest information about EPM, ERP, and Analytics solutions to meet your business needs.